- Policy Announcements

- Back to Main Page

Q1 2023 Quarterly Forecast Tracker

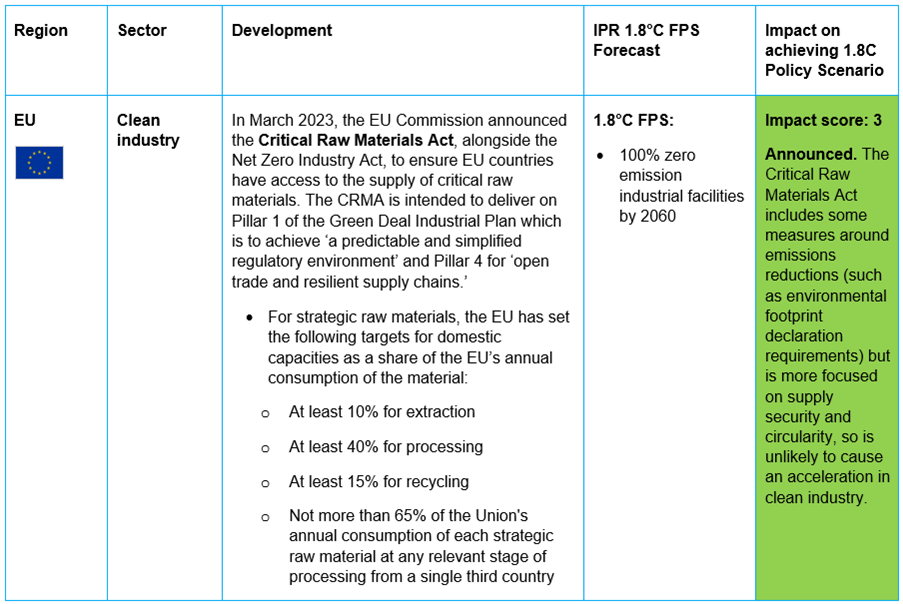

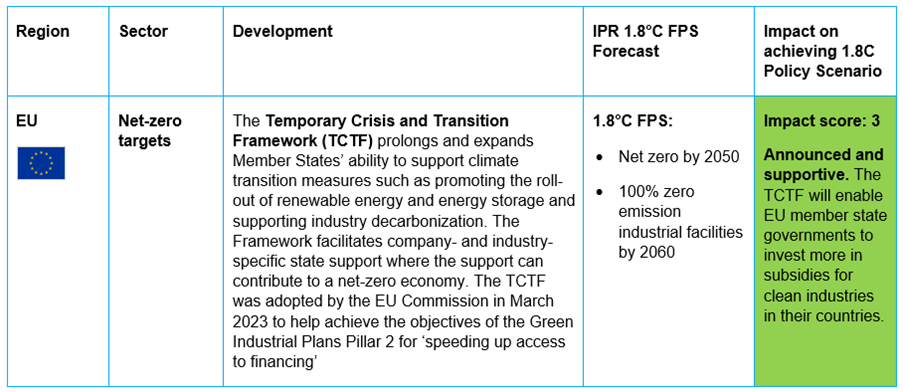

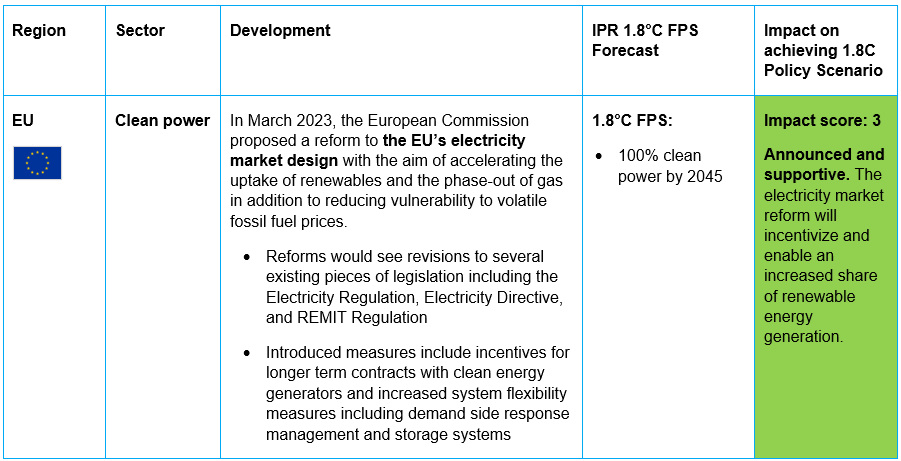

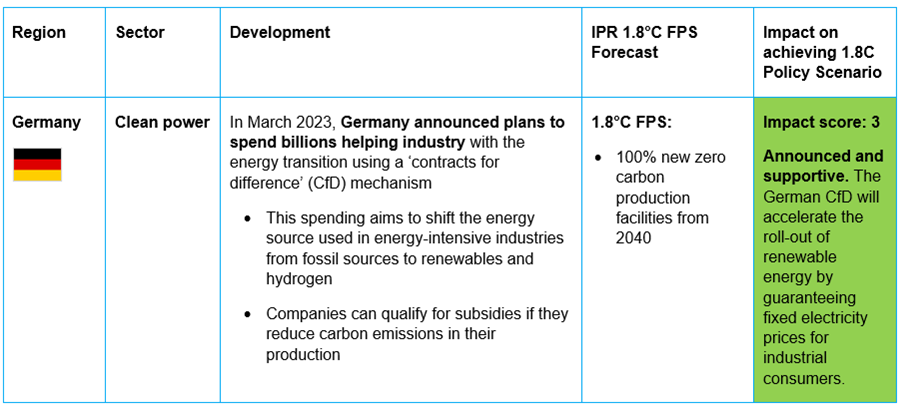

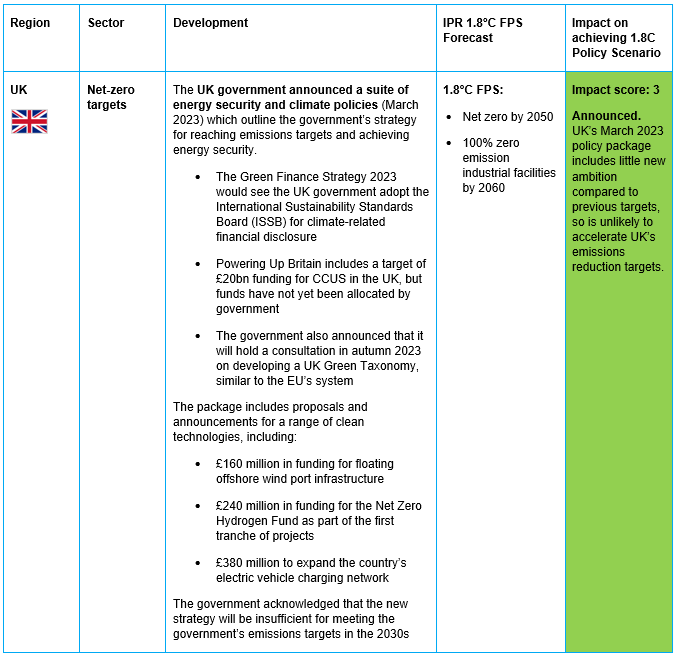

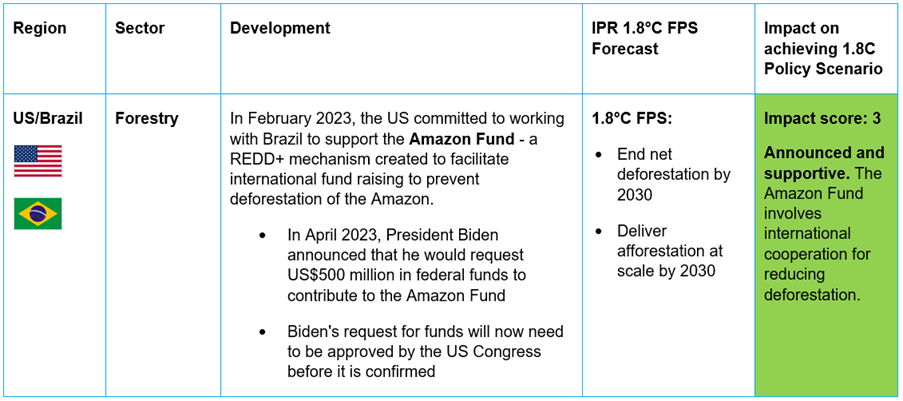

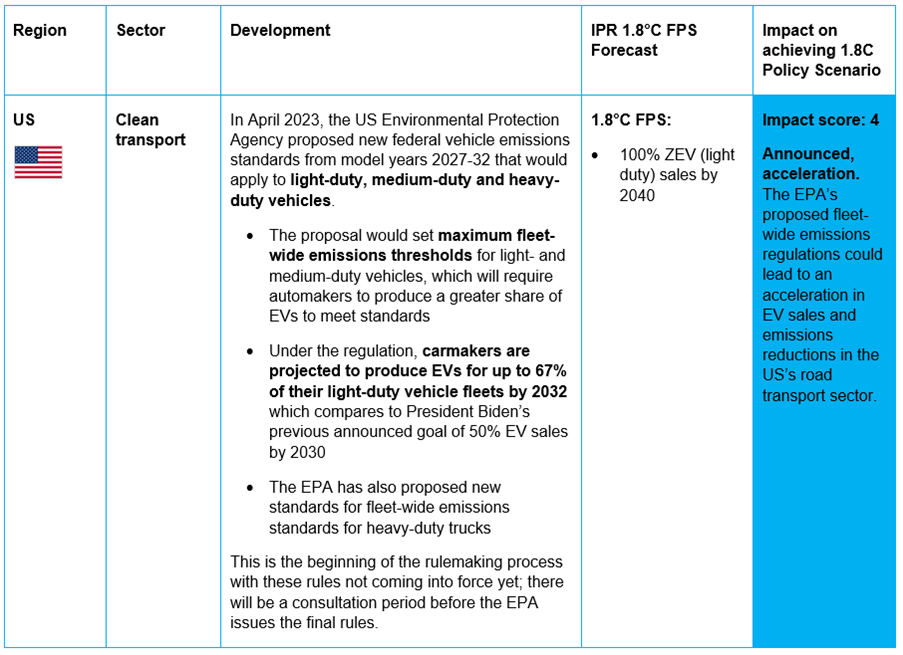

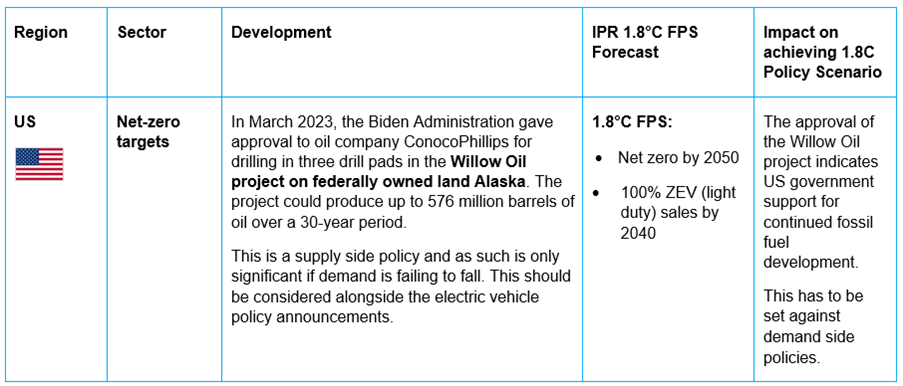

IPR continues to track climate policy and technology developments as part of its 2023 Quarterly Briefings.

Quarterly Forecast Trackers (QFTs) assess in detail global developments in key sectors and regions driving the energy and land transition, determining any acceleration, deceleration or stagnation in policy ambition that could impact achieving climate reference scenario outcomes, including well-below 2°C scenarios such as IPR’s 1.8°C Forecast Policy Scenario (1.8°C FPS).

Of note, during the first Quarter of 2023:

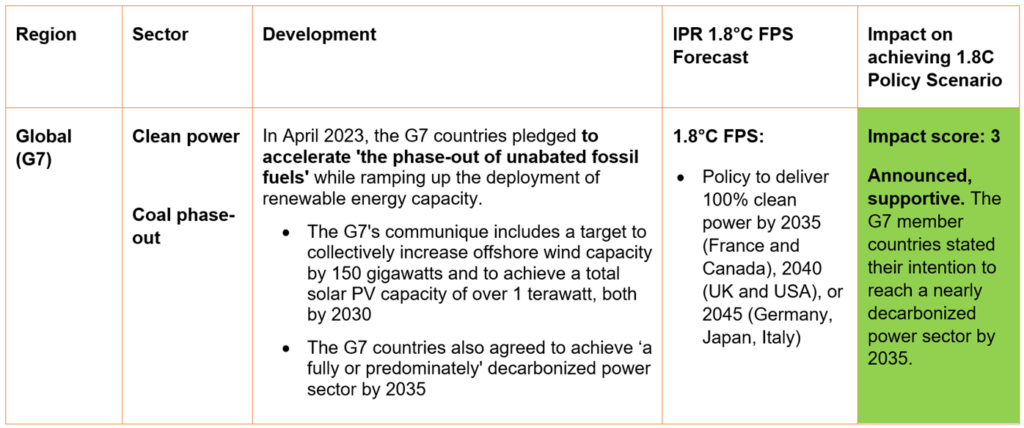

- G7 countries pledged to accelerate the phase out of unabated fossil fuels while ramping up renewable energy capacity with the aim to predominantly decarbonize the power sector by 2035.

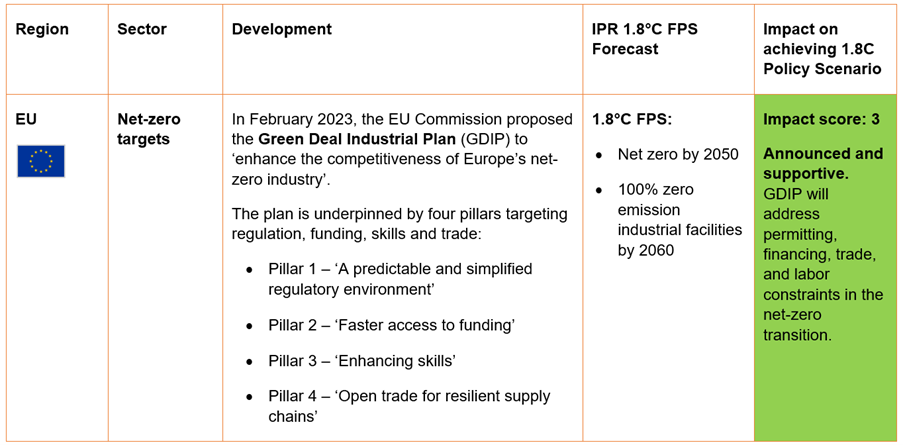

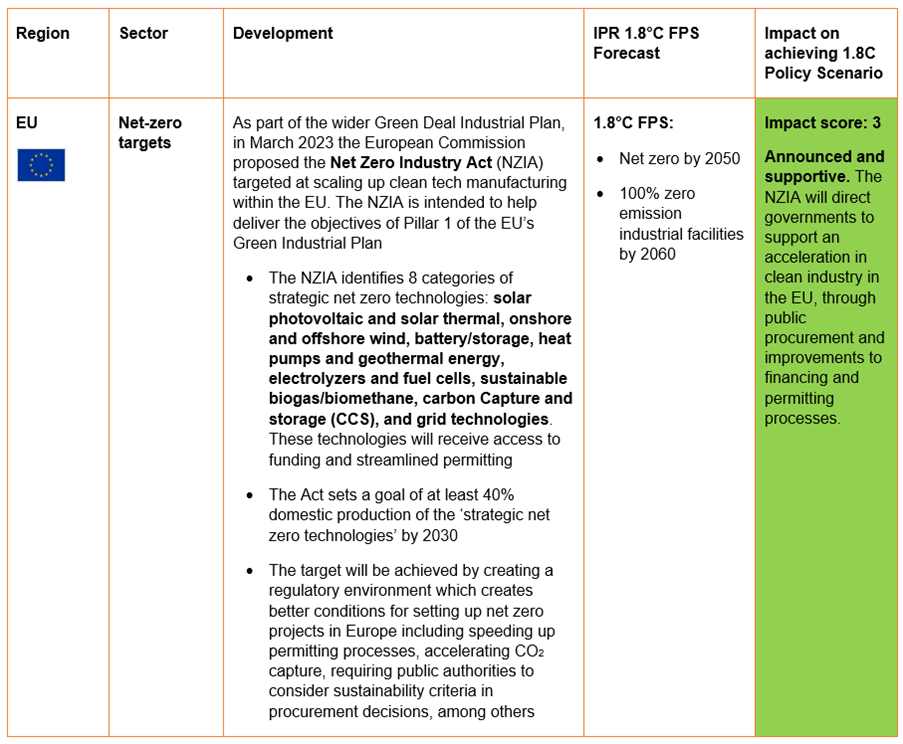

- The Green Deal Industrial Plan (GDIP), the EU’s response to the US Inflation Reduction Act, aims to increase support and scale up manufacturing capacity of net-zero technologies, proposing ~EUR 250bn of reallocated funding. For a detailed update, see Kaya Advisory’s briefing “Investor Q&A: Eight burning questions on the EU’s new industrial policy”.

Following negotiations in 2022, the European Parliament also adopted key Fit for 55 laws to achieve the 2030 climate target, including reform of the ETS (including aviation and shipping), the CBAM and a new Social Climate Fund. - In the US the major development is proposed vehicle emissions standards that would target 67% zero emissions vehicle sales by 2032. The Environmental Protection Agency is also expected to propose regulations that would limit carbon emissions from power plants which already exist, in addition to setting limits on emissions form new power plants. The regulations would require coal- and gas-fired power plants to reduce or capture nearly all their GHG emissions by 2040. This would be a first of the federal government and tackle a source of 25% of US GHG emissions. The proposal will be open for comments for several months and may face political and legal opposition before it is adopted, meaning its final form is still uncertain.

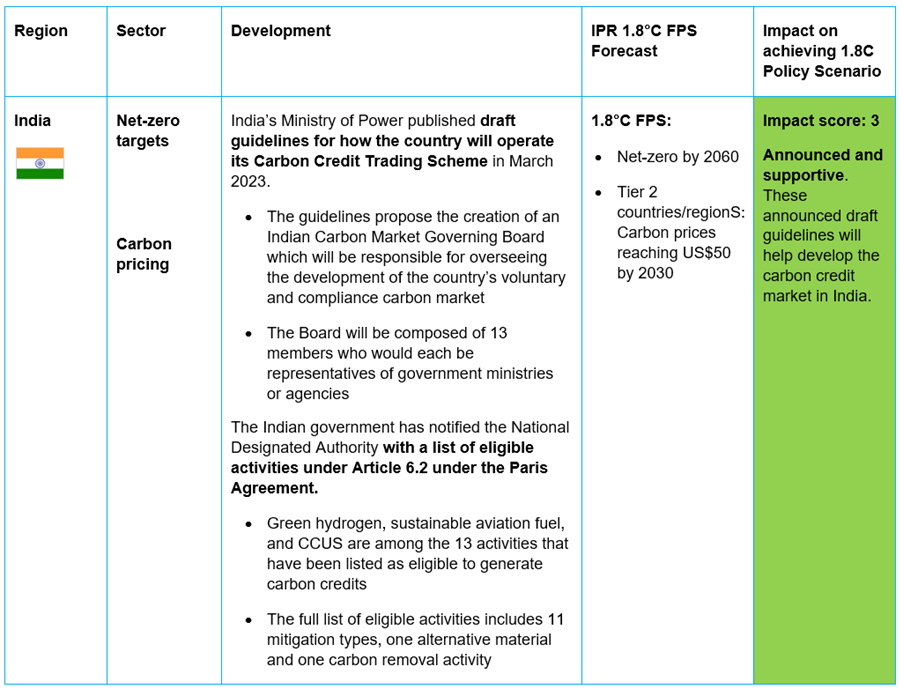

- India advances on its voluntary carbon market scheme (CCTS) with guidance issued on governance and eligible activities

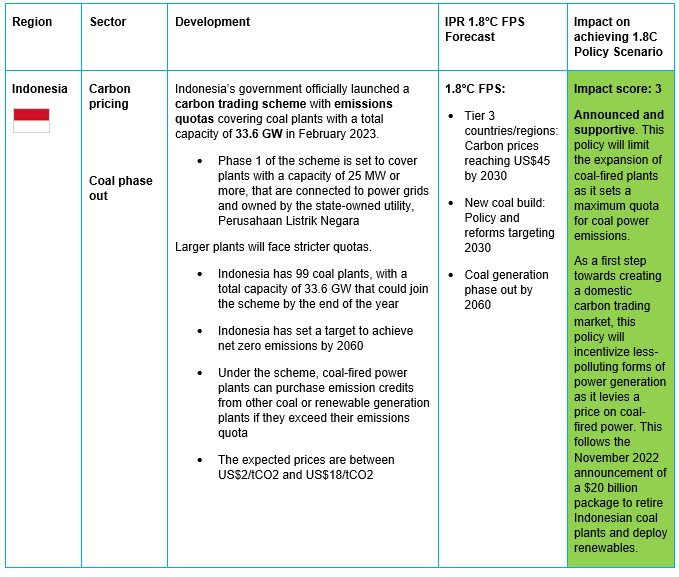

- Indonesia officially launched a carbon trading scheme with emissions quotas covering coal plants. This follows the November 2022 announcement of a $20 billion JETP package with the International Partners Group

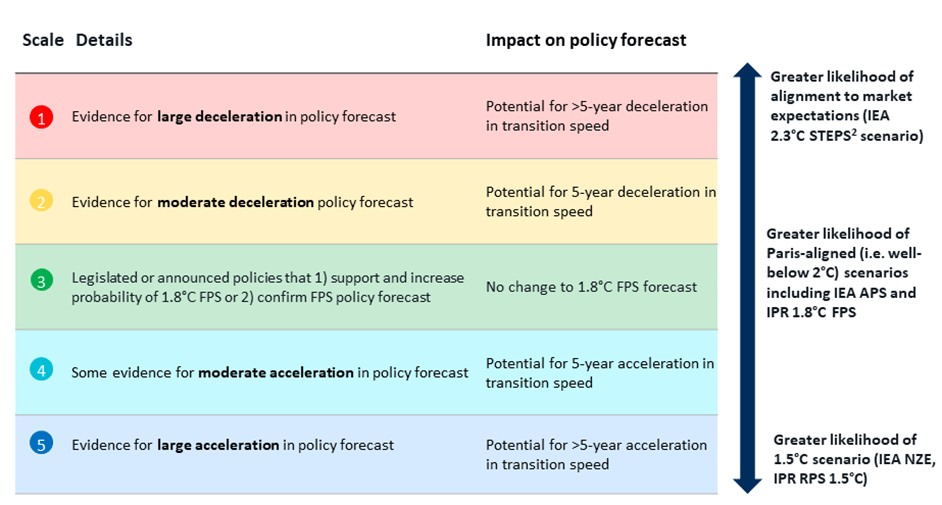

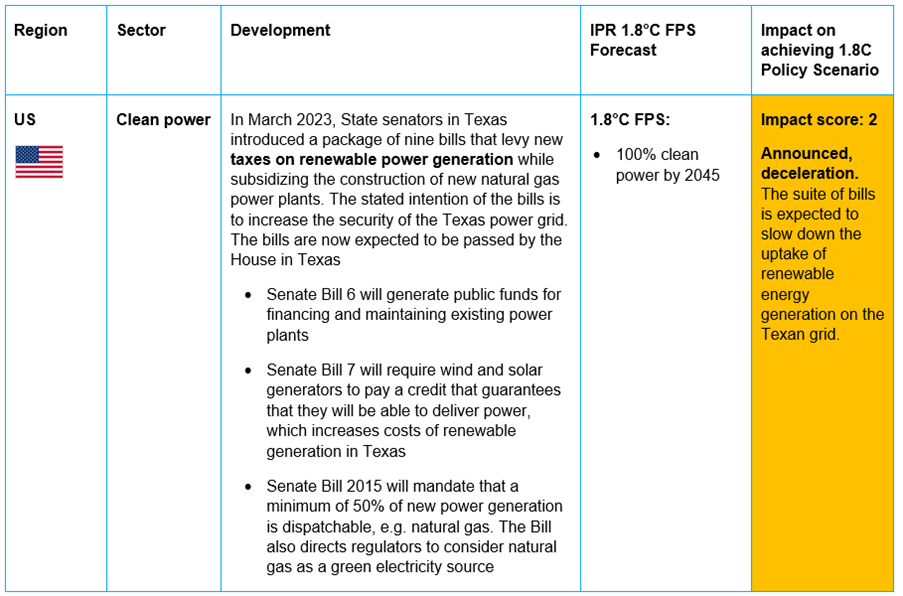

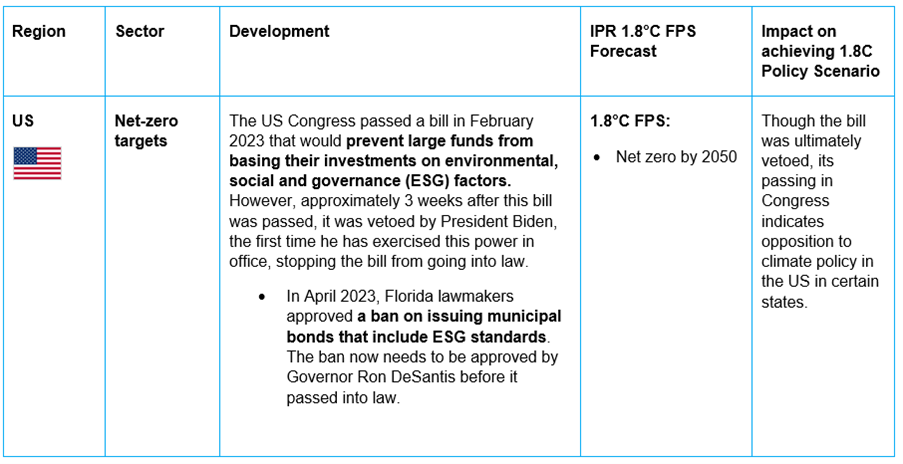

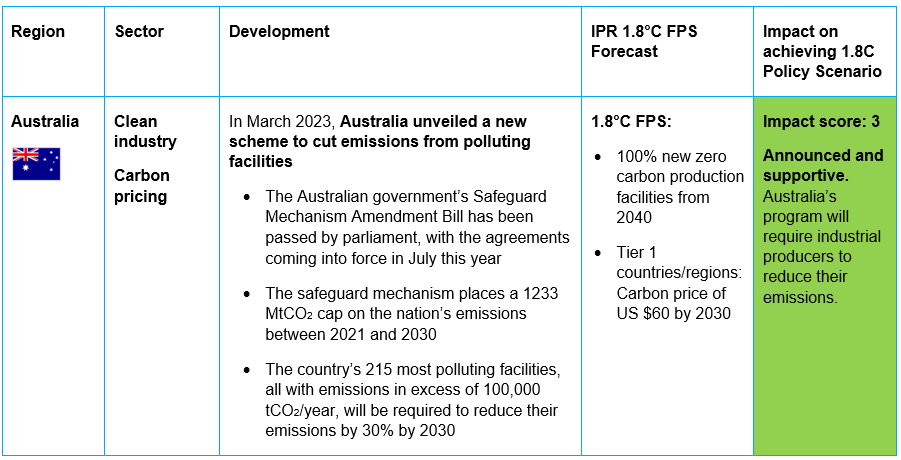

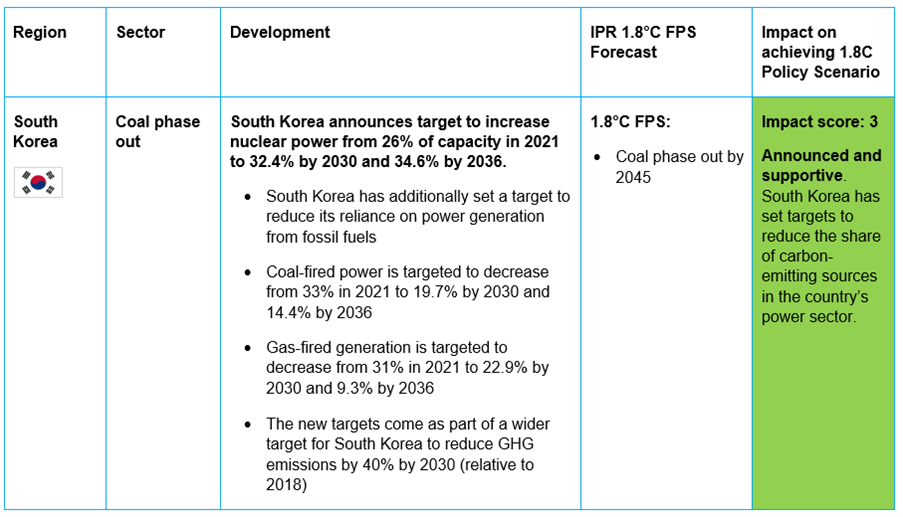

Summarized below are the top key developments tracked between January and April 2023. Policy developments are assessed based on policy impact relative to reference climate transition scenarios on a 5-point rating scale (see assessment methodology below table)

Click through the images below to see the top climate policy developments over the past quarter across the most important markets or download the complete table here.

IPR Quarterly Forecast Tracker developments are assessed based on policy impact relative to reference climate transition scenarios