- IPR Intelligence

- Back to Main Page

Navigating the Future of Bioenergy in the Climate Transition

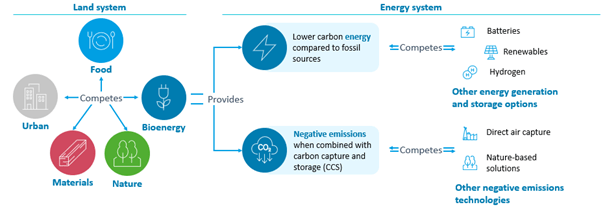

In a world grappling with the urgency of climate change, the role of bioenergy in the climate transition is a topic of growing significance for policy makers and investors. It sits at the nexus of the land and energy systems and competes for limited resources with system outcomes such as food and biodiversity. Designing policy to meet this challenge is crucial. If bioenergy were encouraged indiscriminately there could be serious negative consequences.

Modern biomass use in the energy system is recent and currently occupies around 5% of global cropland (83Mha) and produces 30 EJ of energy after conversion losses. Because its use for energy is still evolving and policy frameworks are still emerging, it remains poorly understood.

While most climate scenarios project significant future bioenergy growth, the Inevitable Policy Response 2023 Forecast Policy Scenario (FPS) forecasts modern biomass for energy to grow only moderately to occupy less than 1% more cropland (91Mha total), producing 41 EJ of energy after conversion losses by 2050.

Although the associated increase in land area is small, this will involve a complete shift from first generation bioenergy crops such as corn (with low energy density) to second generation bioenergy sources such as agricultural residues; as well as a major shift from current, less sustainable areas of production to more sustainable land areas that limit impacts on biodiversity and food prices.

The shift in expectations emerging from IPR’s 2023 Bioenergy Report comes from its more detailed assessment out to 2050 of the tradeoffs associated with bioenergy production and its assessment of likely future policy developments.

The IPR analysis moves beyond other scenarios, which account for the economic and direct carbon costs of biomass but typically assume the land system supplies whatever sustainable biomass the energy system demands.

We believe that IPR FPS 2023 should help reshape the world’s perspective on bioenergy’s future.

The true cost of bioenergy

Bioenergy is costly for the land system to produce but can facilitate decarbonization by delivering both low carbon energy and negative emissions when used with carbon capture and storage (CCS).

Growing biomass incurs two types of costs in land:

Land costs – Bioenergy competes for scarce land in a system increasingly asked to provide more space for food, materials, natural ecosystems and urban areas.

Carbon costs – Emissions created from growing biomass in the land system in place of natural vegetation. In a climate constrained world these will need to be counted.

To be useful in the energy system transition, bioenergy must be either lower cost or be more sustainable than other decarbonization technologies when fully accounting for the land system costs incurred from the production of biomass.

Both carbon and land costs vary substantially by the type of bioenergy feedstock used, but they are typically much larger than many models have assumed to date.

Figure 1 outlines this relationship:

Sustainability guardrails and a positive carbon payback

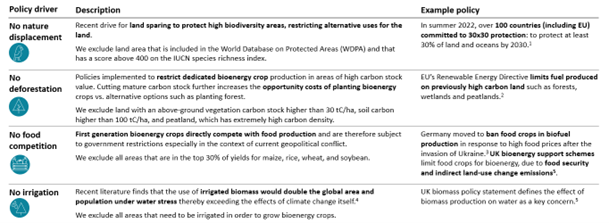

As our global demand for resources increases, the competition for land becomes fierce. IPR FPS 2023 sees four major guardrails emerging that will limit the production of dedicated bioenergy crops to avoid high environmental costs:

- avoiding nature displacement

- deforestation

- food competition

- depletion of scarce water resources

These guardrails help ensure that land committed to bioenergy crops meet basic environmental sustainability criteria given the importance of striking a balance between bioenergy production and other land uses.

Figure 2 provides a broad outline:

Applying four guardrails can limit the high environmental costs of dedicated biomass:

In addition to meeting the four basic guardrails, policy will be increasingly focused on ensuring bioenergy truly delivers the emissions avoidance or removal desired, especially in comparison to other alternatives. Carbon payback periods (CPP) measure the time it takes for bioenergy crops to absorb more carbon than the most attractive alternative, generally reforestation or natural regrowth. This metric is critical in assessing the opportunity cost of using land for bioenergy.

Proper accounting for the carbon payback period reduces the amount of emissions avoided by using biofuels and the amount removed through Bioenergy with Carbon Capture and Storage (BECCS) because some carbon would have been removed through reforestation or natural growth in the area in which bioenergy crops were grown.

For policy makers setting the rules for bioenergy, biofuels and BECCS are only viable when the value of the net carbon saved is greater than the value of emissions reductions or removals offered by competing technologies.

A fundamental shift in the land suitable for biomass

Once accounting for these guardrails, there are two sources of potentially sustainable biomass. Firstly, approximately 30 EJ of potential supply might come from waste and residue feedstocks that minimally compete for land and are currently underutilized. Secondly, any bioenergy demand beyond that must be met with land dedicated to growing biomass.

By 2050, IPR the Bioenergy Report finds that 310-396 Mha of land will be available that meets the four guardrails and provides a low carbon payback period. However, most of this land is in arid or cold biomes, and none is in tropical biomes where re/afforestation is likely to be a more efficient store of carbon.

The current bioenergy capital stock, which is largely in the temperate and tropical regions of North and South America and Europe, does not match locations of sustainable dedicated supply. This implies a need for the industry to transition away from first generation crops toward waste and residues and build out new infrastructure more suited to sustainable sources of supply.

How well does bioenergy compete with alternatives in the energy system? Don’t expect huge BECCS deployment:

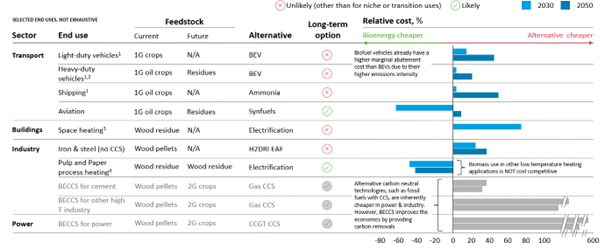

Among the wide range of proposed uses for unabated bioenergy, there are only three that are likely to be competitive:

- aviation,

- shipping

- pulp & paper industry

In each of these areas, low carbon alternatives to bioenergy are expensive and/or technologically immature; and very inexpensive supply of waste and residues make unabated bioenergy cost competitive through to 2050.

Biofuels are expected to dominate aviation decarbonization for the next couple of decades, offering a competitive edge over synthetic fuels whose future remains dependent on uncertain technological advancements.

Other commonly mentioned uses for unabated bioenergy, including for road transport and heating buildings are not competitive versus other low or zero carbon alternatives.

Nevertheless, the benefits of abated bioenergy – bioenergy with carbon capture and storage (BECCS) – remain strong in some instances and offer an important source of negative emissions in the coming decades. BECCS in industry and power will be attractive options where biomass can be secured from land with relatively low carbon payback periods.

This presents some limitations, since the relative value of BECCS falls away quickly where biomass supplies incur a higher carbon payback period, especially as Direct Air CCS (DACCS) technologies mature and their cost falls.

As a result, IPR FPS 2023 forecasts that BECCS will reach 13 EJ and 1 GT CO2e sequestered by 2050 – a substantial contribution to overall NETS in the system.

However, in FPS, its role is overshadowed by DACCS which emerges as the primary source of technological removals beyond 2050. IPR will outline more detailed views on the role of DACCS later in the year.

Figure 3 outlines Bioenergy options versus alternatives:

Bioenergy is a long-term decarbonization option in aviation and some niche uses, but is not cost competitive otherwise:

Balancing bioenergy, carbon removals & ecosystems

Combining more complete accounting of land costs and the competitiveness of alternative technologies, the 2023 IPR FPS forecasts modern biomass for energy to grow only moderately to occupy 91 Mha, around 6% of crop land, producing 41 EJ of energy after conversion losses. Nevertheless, this involves a major shift in the type and location of biomass supply.

As such, IPR presents a complex picture of bioenergy’s future out to 2050. While it faces challenges related to land scarcity and sustainability, it remains a critical player in decarbonizing certain industries like aviation. However, the path forward involves more effective balancing between bioenergy production, carbon removal and the preservation of vital ecosystems.

As technology and policy evolve, bioenergy’s role in our energy transition will adapt in ways that break with the patterns set over previous decades.

This presents an industry disruption that should be of keen interest to financial institutions and corporates active in this space.

————————————

IPR FPS 2023 suite of publications, including policy forecasts, scenarios and the associated detailed energy, land and bioenergy reports can be found here.